|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

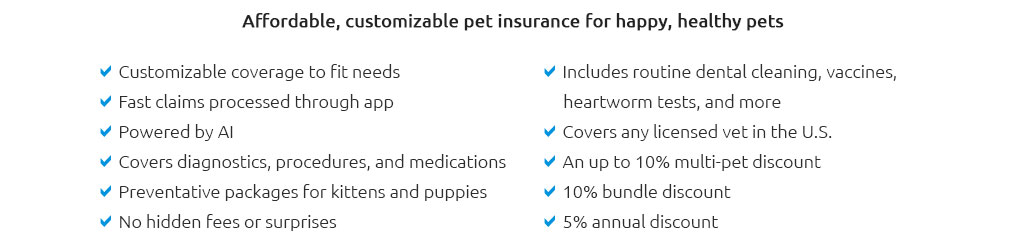

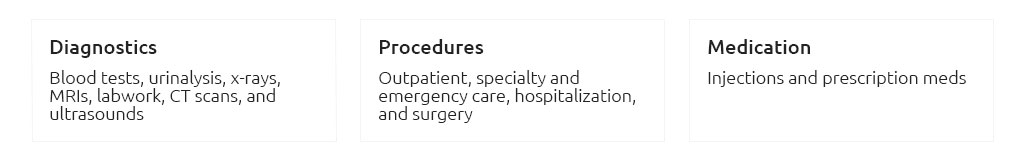

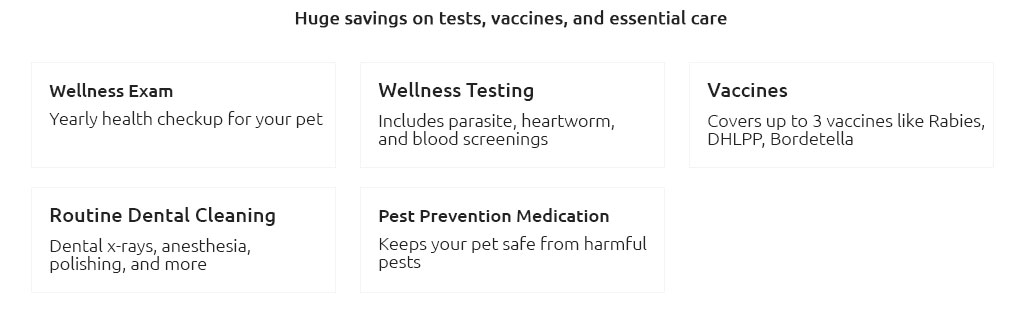

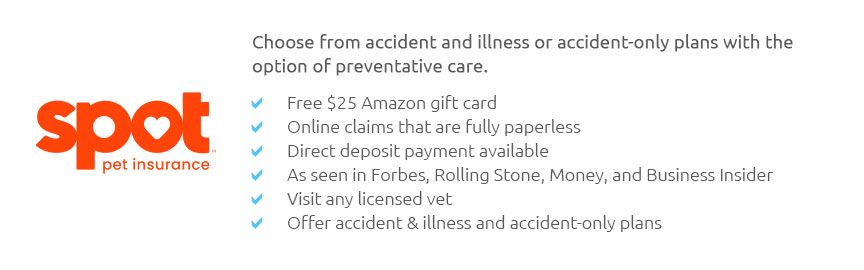

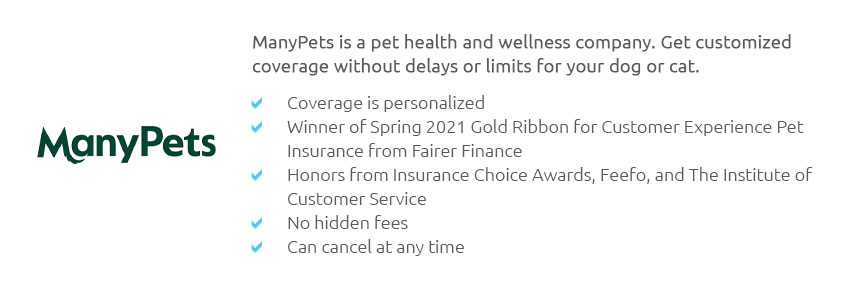

Understanding Pet Insurance Coverage Plans: Quick Facts and InsightsIn today's world, the concept of pet insurance has gained remarkable traction, offering a safety net for pet owners who wish to ensure their beloved companions receive the best possible care without the burden of exorbitant costs. With veterinary expenses soaring, pet insurance has emerged as a prudent choice, providing peace of mind and financial security. Pet insurance plans typically cover a range of incidents, from accidents and illnesses to routine care, depending on the policy chosen. However, navigating the landscape of pet insurance can be daunting given the plethora of options available. Let us delve into the nuances of pet insurance coverage plans to better understand what they entail and how to select a plan that best suits your needs. At the heart of pet insurance lies the concept of coverage. Coverage can vary significantly between providers, with some plans offering comprehensive coverage that includes accidents, illnesses, hereditary conditions, and even alternative therapies, while others may limit their scope to basic accident and illness coverage. One must assess their pet's specific needs and health history to determine which plan is most appropriate. Understanding the fine print is crucial, as some policies might exclude pre-existing conditions or impose age limits, which can be a deciding factor for many pet owners. Moreover, the cost of pet insurance is an essential consideration. Premiums can vary based on the type of coverage, the breed and age of your pet, and your location. While some might view these premiums as an added expense, others see it as a valuable investment in their pet's health and well-being. It is advisable to compare quotes from different insurers, paying attention to the deductible, reimbursement level, and annual limit, as these elements collectively shape the overall value of a policy. Another vital aspect of pet insurance is the claims process. A seamless and efficient claims procedure can significantly enhance the user experience, allowing pet owners to focus on their pet's recovery rather than bureaucratic hurdles. Reading customer reviews and seeking recommendations can provide insights into an insurer's reputation and reliability in handling claims. Additionally, some insurers offer direct billing options, which can be a boon for those who prefer not to manage out-of-pocket expenses upfront. In conclusion, pet insurance coverage plans serve as a crucial tool for safeguarding the health of our furry friends. While the decision to purchase pet insurance is ultimately a personal one, informed by individual circumstances and priorities, understanding the key elements of these plans can empower pet owners to make educated choices. The peace of mind that comes with knowing your pet is protected is, indeed, priceless. Frequently Asked QuestionsWhat does pet insurance typically cover? Pet insurance usually covers accidents and illnesses. Some plans extend to cover hereditary conditions, alternative therapies, and even preventive care, depending on the provider and policy selected. Are pre-existing conditions covered by pet insurance? Most pet insurance policies do not cover pre-existing conditions. It's crucial to review the policy details to understand any exclusions that may apply. How are pet insurance premiums determined? Premiums are typically based on factors such as the type of coverage, the pet's breed and age, and the owner's location. Comprehensive plans tend to have higher premiums. What should I consider when choosing a pet insurance provider? Consider the scope of coverage, cost, claims process, and customer reviews. It's essential to select a provider with a reputation for reliability and excellent customer service. Can I get pet insurance for an older pet? Yes, but options may be limited, and premiums may be higher. Some insurers impose age limits, so it's advisable to check with the provider for specific terms and conditions. https://www.petco.com/shop/en/petcostore/insurance

Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet discount. Two cats on our most popular plan would cost about ... https://www.chewy.com/pet-insurance/

CarePlus offers a unique selection of pet insurance plans, which you can buy standalone or bundle with a wellness option (coverage by state may vary). Insurance ... https://www.healthypawspetinsurance.com/

The top-rated cat insurance & dog insurance plans cover accidents, illnesses, cancer, emergency care, genetic and hereditary conditions, breed-specific ...

|